tesla tax credit 2021 colorado

Tesla is installing Tesla. Purchased alternative fuel vehicle.

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Tesla Model 3 Performance EVs wont qualify for the tax credit while more basic trims will.

. EV Federal Tax Credit for 2021 Tesla I purchased my Tesla Model Y in late Feb. Individuals would have to. For buyers who are eager to purchase an electric vehicle.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Sunday March 6 2022Edit. TaxColoradogov prior to completing this form to review our publications about.

Innovative Motor Vehicle Credit and Innovative Truck Credit Tax Year 2021 Instructions DR 0617 071321. Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data. The Model Y is one of Teslas best-selling cars but does it qualify for the 7500 federal tax credit.

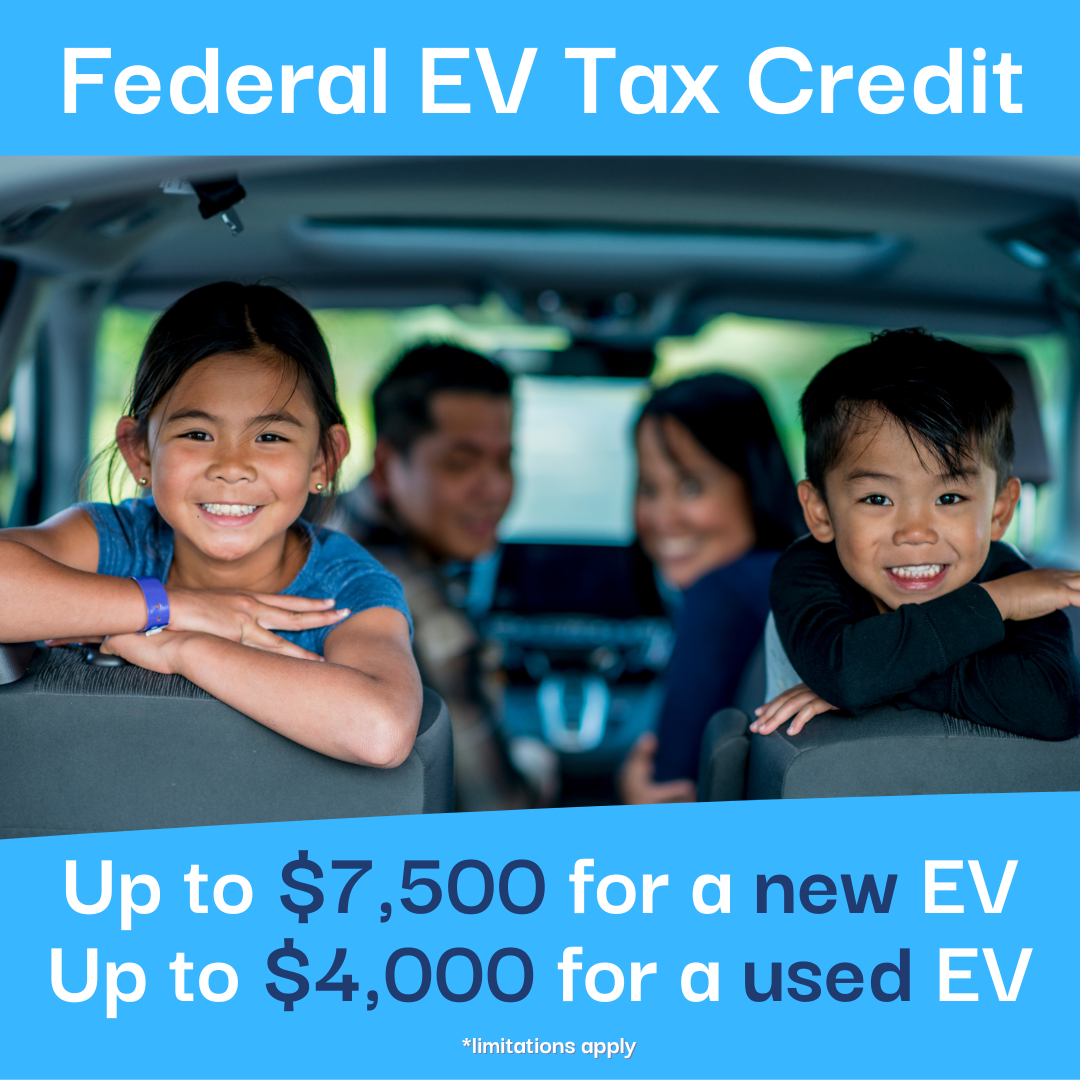

The tax credit also isnt available for those with a taxable income higher than 150000 or 300000 if filing jointly. One Tesla that should qualify for the. If the stipulations in S2118 get passed this year yes the credit for a Tesla would be worth 7500 for deliveries after May 24 this year and bump up to 10000 for 2022.

State Income Tax Credits for Innovative Fuel Vehicles. Jul 28 2022 The Act would provide up to 7500 in credits for electric SUVs trucks and vans priced up to 80000 while cars would have to cost 55000 or less. The Tesla Model 3 is one of the worlds best-selling electric vehicles but does it qualify for a federal tax creditThe Model 3 expertly blends performance with affordability with.

Tesla S Market Share Is At Risk Of Plunging Analyst. Credit Amounts for Vehicles Leased by Transportation Network Companies Tax year beginning on or after. 112017 112020 112021 112023 but prior to.

The incentive amount is equivalent to a percentage of the eligible costs. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. On the website at the time it said there was still a 2000 Federal tax credit available.

Tesla tax credit 2021 colorado. Standalone Powerwall Residential Federal Investment Tax Credit For Systems Installed In. Latest On Tesla Ev Tax Credit February 2022.

Based on the Model 3 sedan the Tesla Model Y is a battery electric. Contact the Colorado Department of Revenue at 3032387378. Why Texas 2 500.

New Ev Tax Credits For Tesla In The Inflation Reduction Act

How To Claim An Electric Vehicle Tax Credit Enel X

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Electric Vehicle Solar Incentives Tesla

Is Your State One Of The Best To Own An Ev Cleantechnica

4 Automakers Ask U S Government To Lift Cap On 7500 Ev Tax Credit

Tesla Increases Model Y Prices Again As New Incentives Are Coming Electrek

Every State That Will Pay You To Buy A Tesla Mediafeed

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

State Electric Vehicle Tax Credits Electric Hybrid Alternative For 2022

Can You Really Shave 25 000 Off The Price Of An Electric Car

What Is An Ev Tax Credit Who Qualifies And What S Next

Tax Credits De Co Drive Electric Colorado

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

Best Electric Luxury Cars In 2022 Carfax

Fact Check The Income Maximum For Electric Vehicle Tax Credit

Tax Credits Drive Electric Northern Colorado